Uganda-Tanzania oil pipeline: Security threats facing the EACOP

As Uganda looks to start oil and gas production amid global energy insecurity, we look at some of the potential threats to the East Africa Crude Oil Pipeline Project (EACOP), which aims to connect Uganda’s oil reserves to international markets.

What is the East Africa Crude Oil Pipeline (EACOP)?

Disruptions in the energy market caused by Russia’s war in Ukraine have raised questions surrounding energy independence and diversification. With Europe’s energy needs heavily impacted, the European Commission outlined a series of measures to make Europe independent from Russian coal, oil and gas. Short and medium-term needs saw an increase in coal exports from Africa to Europe. A number of gas pipeline projects have also been revived, such as the Trans-Saharan Gas Pipeline (TSGP). However, longer-term investment projects were well underway in Africa before Russia’s invasion. One such project is The East Africa Crude Oil Pipeline Project (EACOP), also known as the Uganda-Tanzania crude oil pipeline, which involves crude oil extraction in Uganda, with a 1,443km pipeline running to the coast of Tanzania transporting Uganda’s oil resources to international oil markets.

Uganda’s President Museveni has touted the project as one that can help solve the energy crisis in the West. The EACOP deputy managing director has said the government has so far “made good progress” to secure 60 percent of the capital requirements in the international financial markets. There are a number of regional and local threats the project is likely to encounter over the course of the construction phase and once it becomes operational from 2025. This report offers a brief look at how oil theft, ethnic tensions, terrorism and regional tensions pose a security threat to EACOP.

The East Africa Crude Oil Pipeline (EACOP) Route:

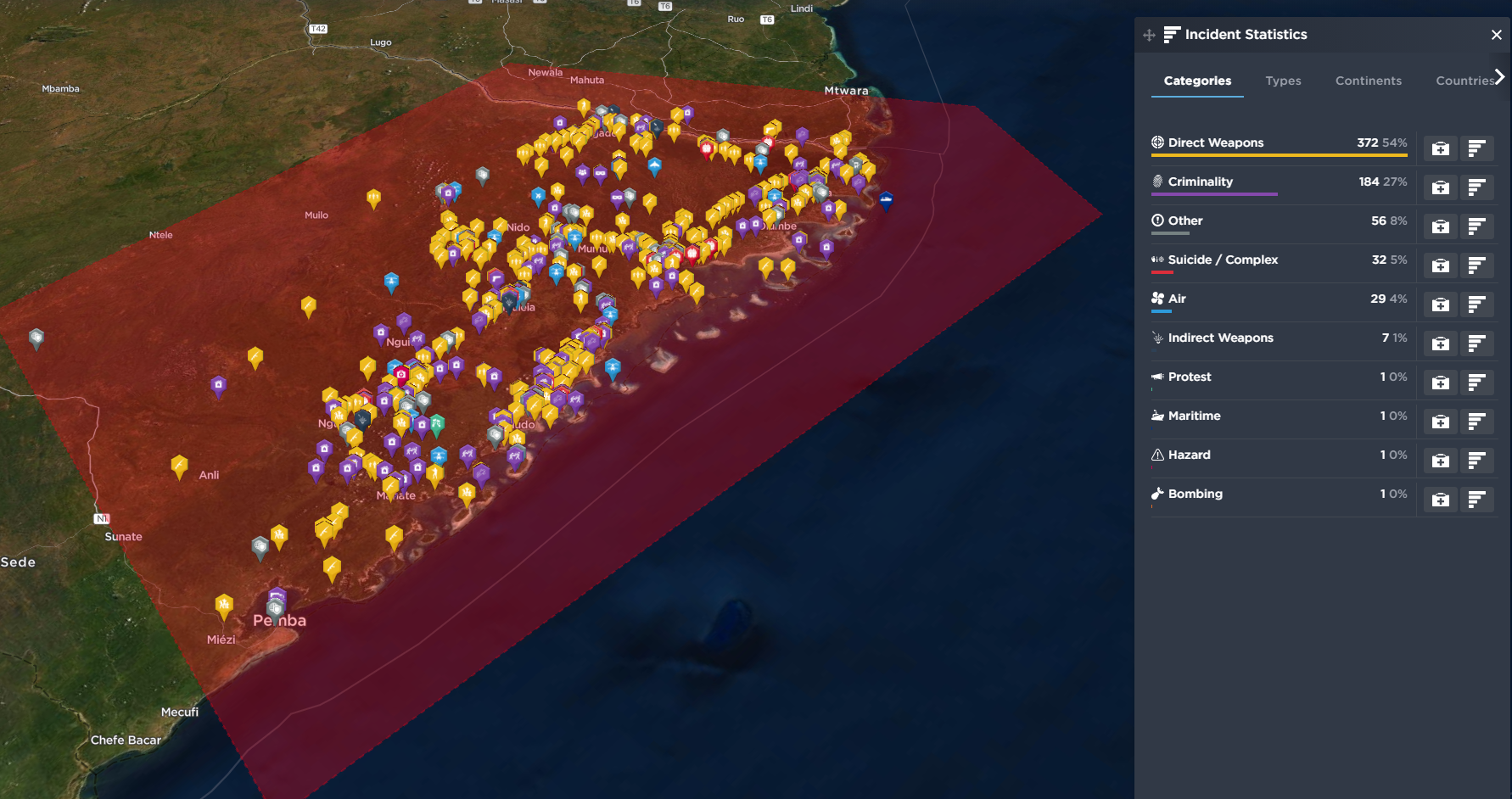

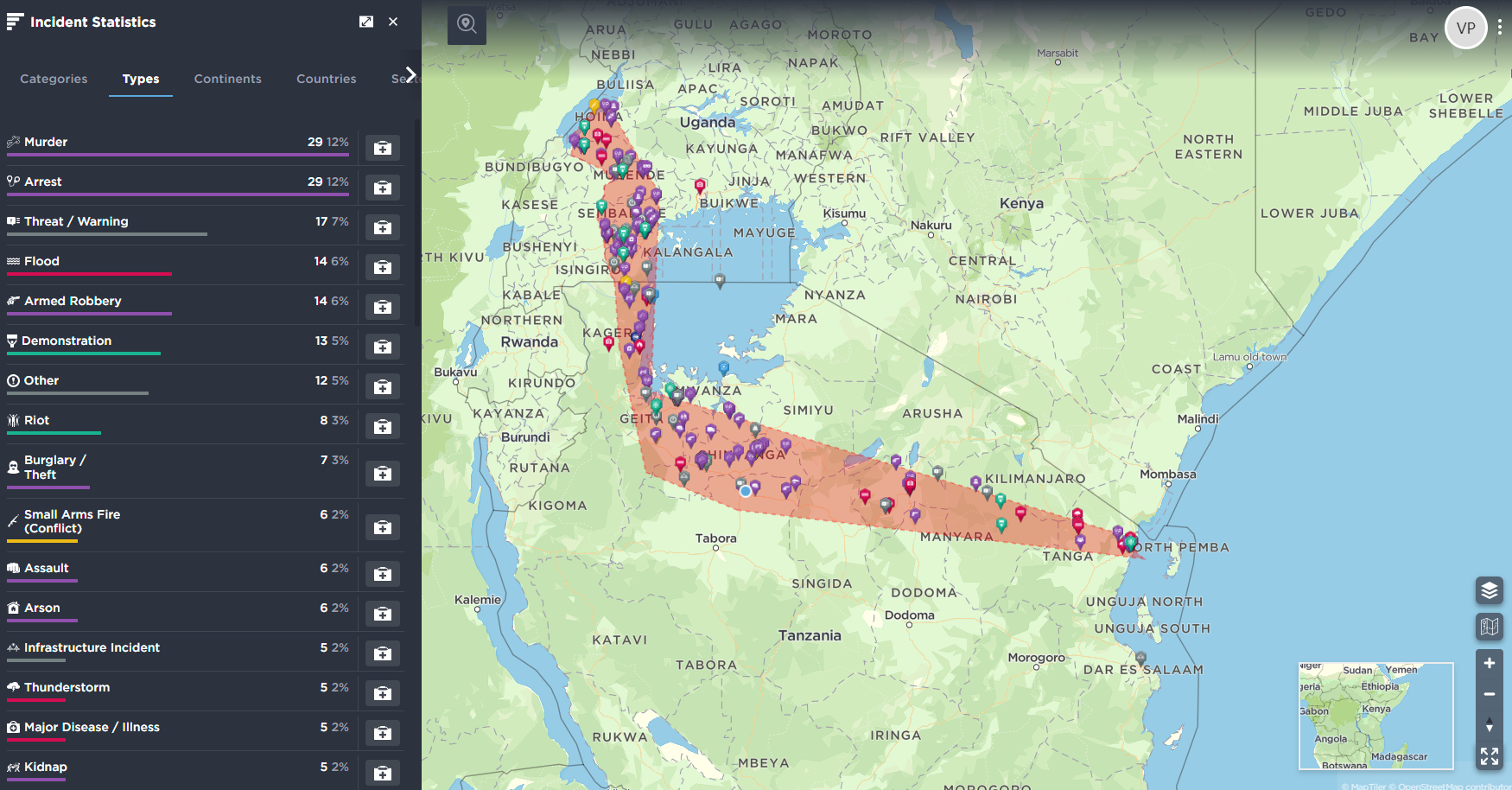

The route of the EACOP runs from the town of Kabaale in Uganda, near Lake Albert, to the port of Tanga, Tanzania. The pipeline will traverse 10 districts and 25 sub-counties in Uganda, and eight regions and 25 districts in Tanzania.

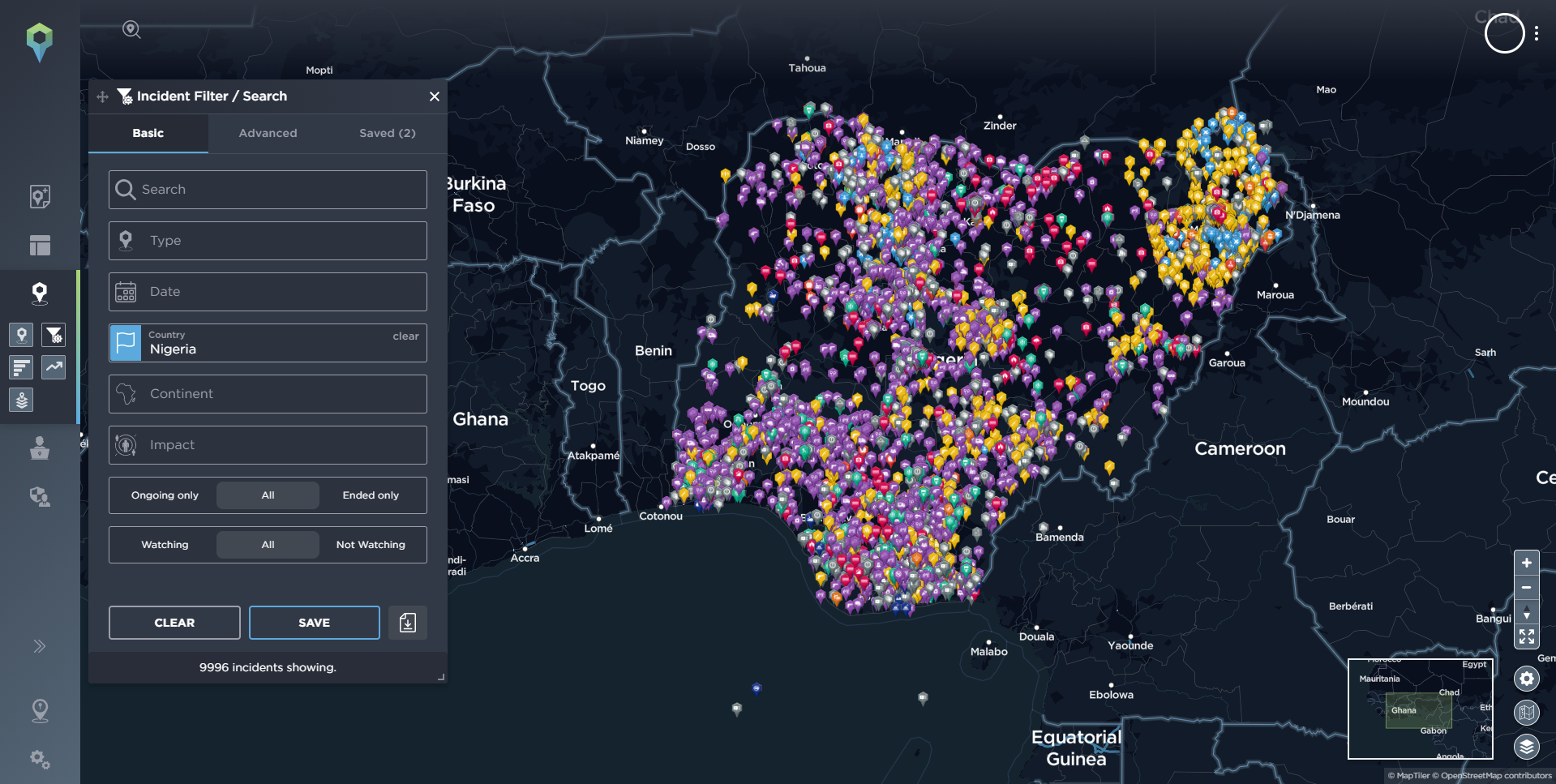

Historical view of crime, conflict, civil unrest, natural hazards incidents along the route of EACOP. [image source: Intelligence Fusion]

Oil theft and vandalism

Using Nigeria as an example, poverty, community-industry expectation mismatch, corruption, unemployment, ineffective law enforcement and poor governance are cited as common factors that have driven oil theft. Rates of poverty and unemployment are comparatively lower in Tanzania and Uganda. However, all three countries have high levels of corruption. In Tanzania, much of the pipeline is located in territory with a high poverty incidence rate relative to the rest of the country.

EACOP will cross more than 200 rivers. Fishing is the main source of livelihoods in Tanga, where a new port in Chongoleani will be built to store and export oil. Nearly a third of the EACOP will lie within the Lake Victoria basin; the lake supports over 40 million inhabitants. Lake Albert supports thousands of fishermen in Uganda and DRC. The lake, where the Tilenga oil field and Kingfisher project are located, also supports subsistence small holder farming in areas around the lake.

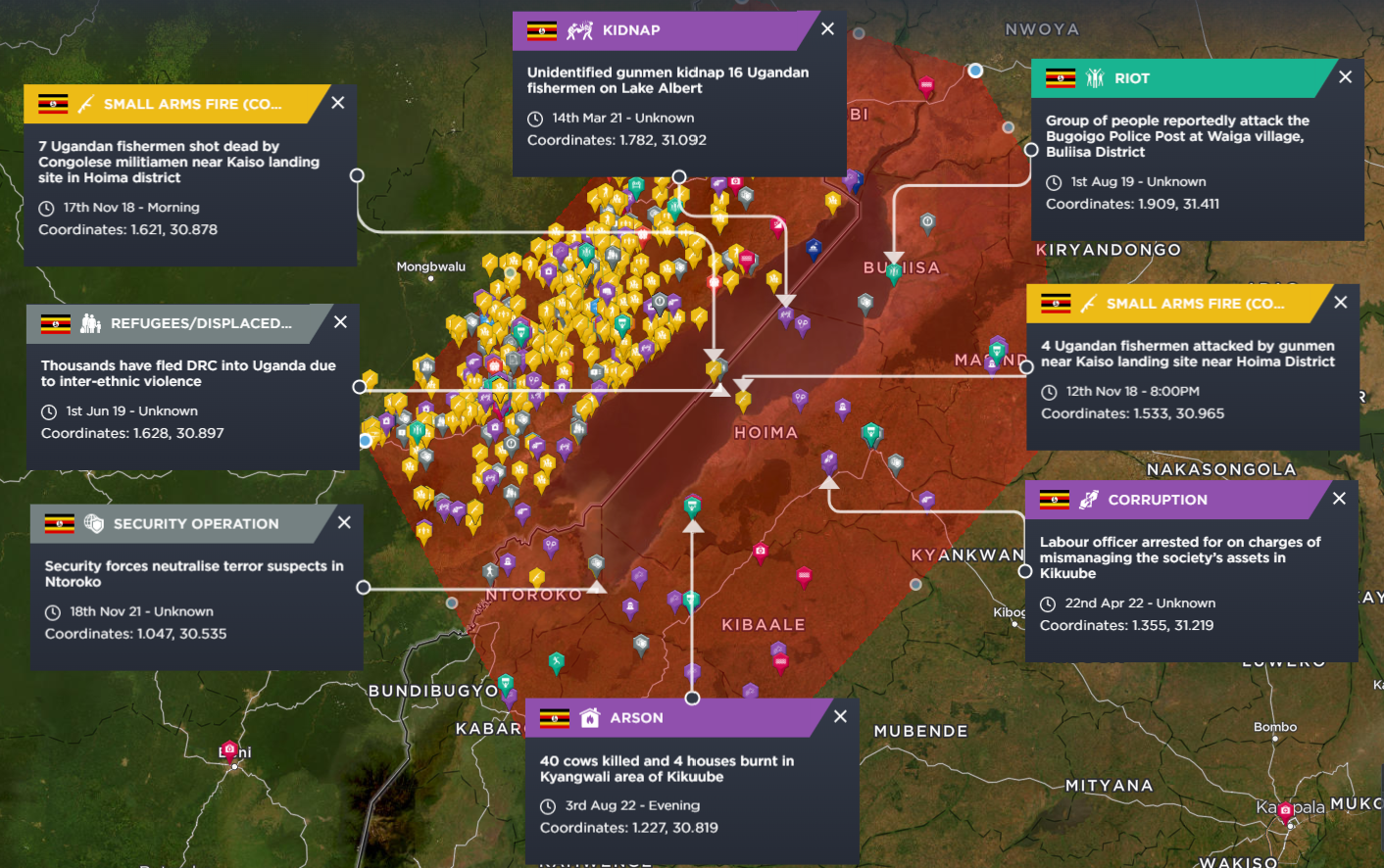

Damage to marine ecosystems caused by oil spills together with existing challenges associated with climate change have contributed to fishermen in Nigeria resorting to illegal activities such as oil theft. Similar trends could take hold in Uganda and Tanzania. Although EACOP will use a fibre-optic cable to monitor both for temperature changes and intrusion along the entire length of the pipeline, the failure of the pipeline could contaminate ground water, thereby harming livelihoods and possibly driving local conflict. Existing tensions between Ugandan and Congolese fishermen – there have been cases of abductions and killings – will almost certainly exacerbate as fish stocks decline. In 2007, gunmen on Lake Albert attacked a boat operated by Canada’s Heritage Oil Corp.

Historical activity around Lake Albert: Rebel groups have carried out attacks on the shore of Lake Albert in DR Congo. The lake is an important source of livelihoods for many people, including fishermen who are members of various ethnic groups. [image source: Intelligence Fusion]

Local conflict

Ethnicity is highly politicised in Uganda. Differences, real or perceived, between ethnic groups do exist, however, and in Kasese and Kibale districts of Uganda, conflict between ethnic groups over limited resources and/or land redistribution has occurred. In Tanzania, despite being an ethnically diverse country, ethnicity has not been politicised and Tanzania has consequently avoided nationalist secession and civil war, although there have been conflicts between pastoralist herders and farmers due to competition for land resources (water and pasture). There are no indications of this evolving into a larger conflict, but ethnicity and religion are key components used to organise. The decrease in access to pasture and water for livestock caused pastoralists to migrate from the north to central, eastern and southern areas, causing conflict between farmers and herders in Kilosa district from 2011 and 2014.

An improper assessment on the impact on livelihoods of persons displaced by the EACOP and surrounding/host communities with external factors in mind (such as erratic weather patterns) could also cause tension between different communities. As has occurred elsewhere in Africa, armed conflict could lead to damage to pipeline infrastructure. Perceived or real differences in success among different ethnic groups could cause some to protest. This could translate into protest activity at pumping stations, for example, as has happened in Libya. According to EACOP, the overall pipeline route has been designed to reduce environmental and social impacts, but some physical displacement and economic displacement (full or partial loss of livelihoods) is unavoidable. Compensation will be or has been provided to affected populations, according to EACOP. More than 100,000 are affected by the project, according to the EU.

Terrorism

The ADF (Allied Democratic Forces), a militant group with Ugandan origins which operates out of DR Congo and has pledged allegiance to IS (Islamic State), have carried out attacks inside Uganda in recent years. IS has a history of attacking oil and gas pipelines, such as in the Sinai Peninsula and in Iraq. Attacks on the extractive sector are an important part of the group’s strategy. Given the potentially transformative role that EACOP could play in the region’s economic fortunes, any attack on the pipeline would serve as a more than just a symbolic victory for the group. Attacks may also be carried out as a way of putting pressure on foreign governments and international companies with interests in the region. For instance, during an attack on the site of a mining company in Mozambique, IS made reference to the large number of “crusader companies” operating in Cabo Delgado province. The group has also accused foreign companies of exploiting natural resources in the region, an indication of how the group exploits local grievances to gain support. Attacks on foreign companies could take other forms, such as kidnapping (often for ransom) of personnel.

Selected incidents related to the ADF/ISIS in Uganda/DRC [image source: Intelligence Fusion]

Regional Tensions

Attacking oil and gas facilities is a conventional war tactic that could be used as part of a strategy of hybrid warfare. Relations between Rwanda and Uganda have thawed in recent years after several years of tensions in which both countries accused the other of espionage, political assassinations and meddling in each other’s domestic affairs risked regional destabilisation. However, mistrust and suspicion between the two countries could grow as interests of both countries diverge in neighbouring DRC. A proxy war in the DRC could escalate into a regional crisis. However, any souring of relations between Rwanda and Tanzania is unlikely to be forthcoming. Both countries have enjoyed improved relations in recent years with Rwanda relying on Tanzania for access to reach international markets as it develops its logistics infrastructure to become a regional logistics hub. Subsequently, any direct attack on EACOP risks harming relations with Tanzania which would ultimately harm Rwandan interests.

The DRC, the UN, the Unites States and several European countries have accused Rwanda of supporting M23 rebels, whereas Ugandan forces, part of the EAC regional force, have deployed to conflict areas around North Kivu capital Goma. [image source: Intelligence Fusion]

Efforts have been made by Uganda and the Democratic Republic of Congo (DRC) in recent years to improve their relationship. Prior to this, both countries had experienced tensions along their shared border – including in Lake Albert – due to security concerns, including refugees, armed groups, and cross-border activities. Nonetheless, in December 2019, the two nations signed an agreement aimed at enhancing their collaboration in various fields such as trade, security, and infrastructure development, indicating a shift in relations.

Threats to oil and gas projects are nothing new, and Intelligence Fusion have been tracking them since we first began operating in 2015. We now have a rich database of more than 900,000 historical incidents – each one verified and mapped by a trained intelligence analyst – with nearly 20,000 new incidents mapped each month, as well as access to a real time unfiltered news feed drawn from over 80,000 different sources.

If you’d like to learn more about how we operate and how we can help transform your risk and security management capabilities, talk to a member of our team now.