The Security Threats Facing the Oil and Gas Industry in Africa

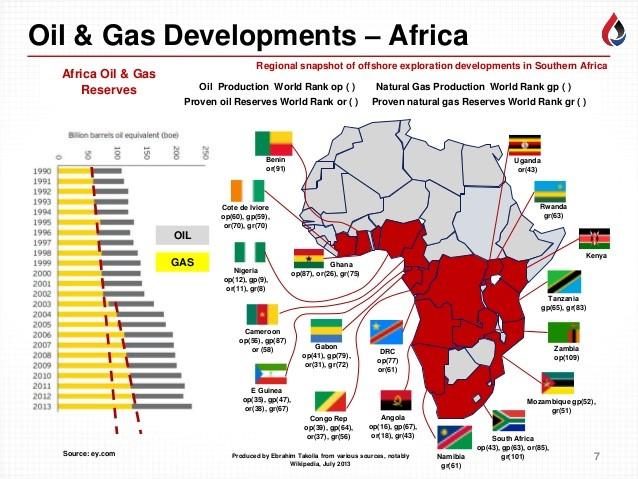

Oil and gas exploration across Africa, particularly Sub-Saharan Africa (SSA), is expected to increase in 2018. Crude oil production in SSA is expected to increase by approximately 323,000 bpd with gas production also expected to increase by 300,000 mmscfd. Increased investment in gas-to-power projects across SSA has added extra impetus for the development of gas projects. Oil and gas companies encounter a plethora of challenges, both tangible and intangible, such as institutional, regulatory, technical, infrastructural factors. Crime, socio-political instability and armed conflict make some areas of the continent a very high-risk environment and present significant threats to the oil and gas industry in Africa, across all three sectors.

Nigeria, Angola, Libya, Algeria, Gabon and OPECs newest member, Republic of the Congo are the largest oil exporters in Africa. However, the likes of Ghana, Equatorial Guinea, Mozambique, Kenya, Senegal, Mauritania, Tanzania and Uganda, have, or are to, invest heavily in the oil and gas sector. Exploration is shifting from West Africa to East Africa and the likes of China, Russia and, recently, the USA have signalled their intentions to invest heavily in oil and gas.

Security Threats to Oil and Gas Companies in Africa

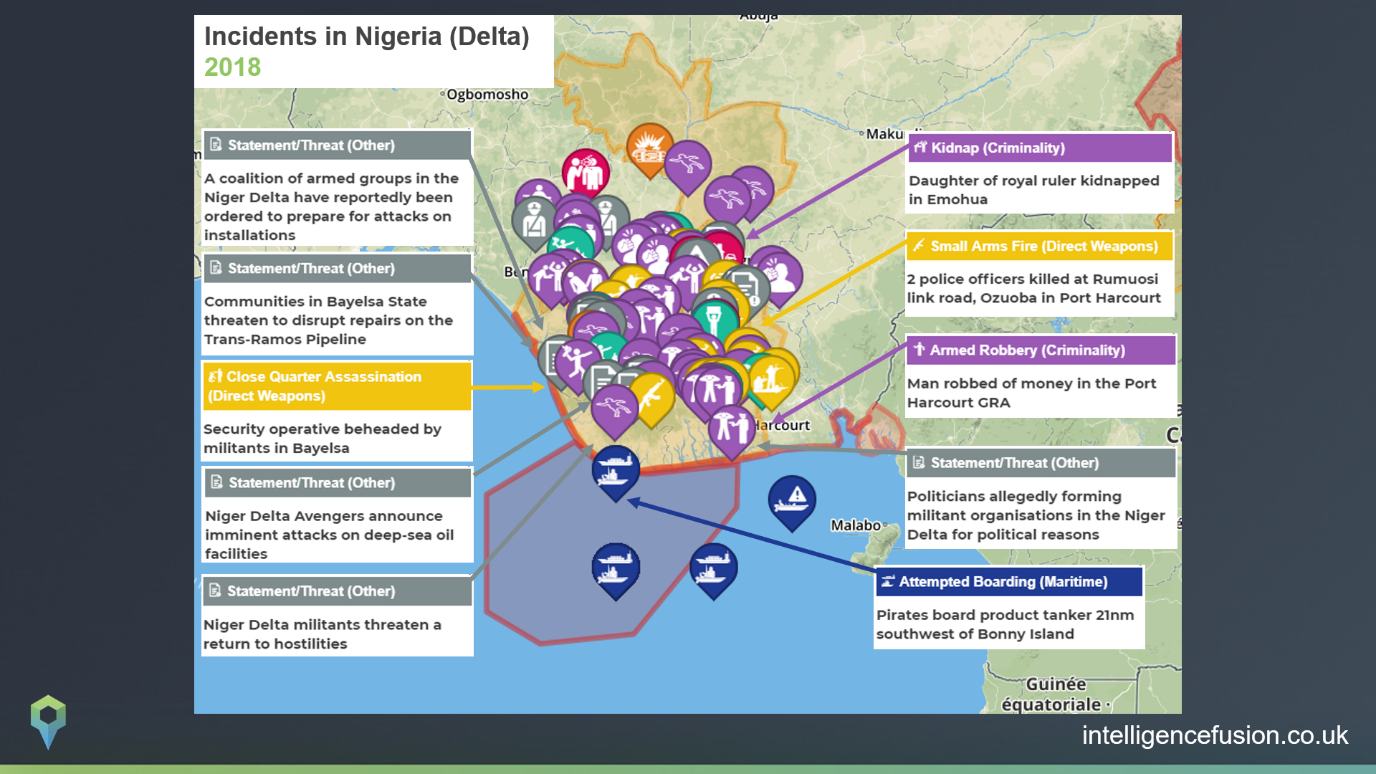

Nigeria: Attacks in Niger Delta

The Niger Delta Avengers attacked oil infrastructure in 2016. In June 2017, the New Delta Avengers, one of the many militant groups, withdrew their threat to attack oil infrastructure. In November 2017, they ended their ceasefire and warned new attacks will be “brutish, brutal and bloody”. The Niger Delta Avengers renewed their threat this year in January: “This round of attacks will be the most deadly and will be targeting the deep sea operations of the multinationals,” the group said in a statement. It said its targets were the Bonga Platform and the Agbami, EA and Akpo fields. The militants also said they would target the Nigerian oil company Brittania-U.

In June 2018, the NDAF warned of planned attacks on oil facilities belonging to Nigeria Agip Oil Company, NAOC. Finally, Militants part of the 21st Century Youths of Niger Delta and Agitators with Conscience, declared Operation No Mercy and Destiny Takeover of God-given Resources. Nigeria lost USD 4,425,145,600 (N1.6 trillion) in 2016 and USD 2,751,887,420 N995 billion in 2017 to crude oil theft.

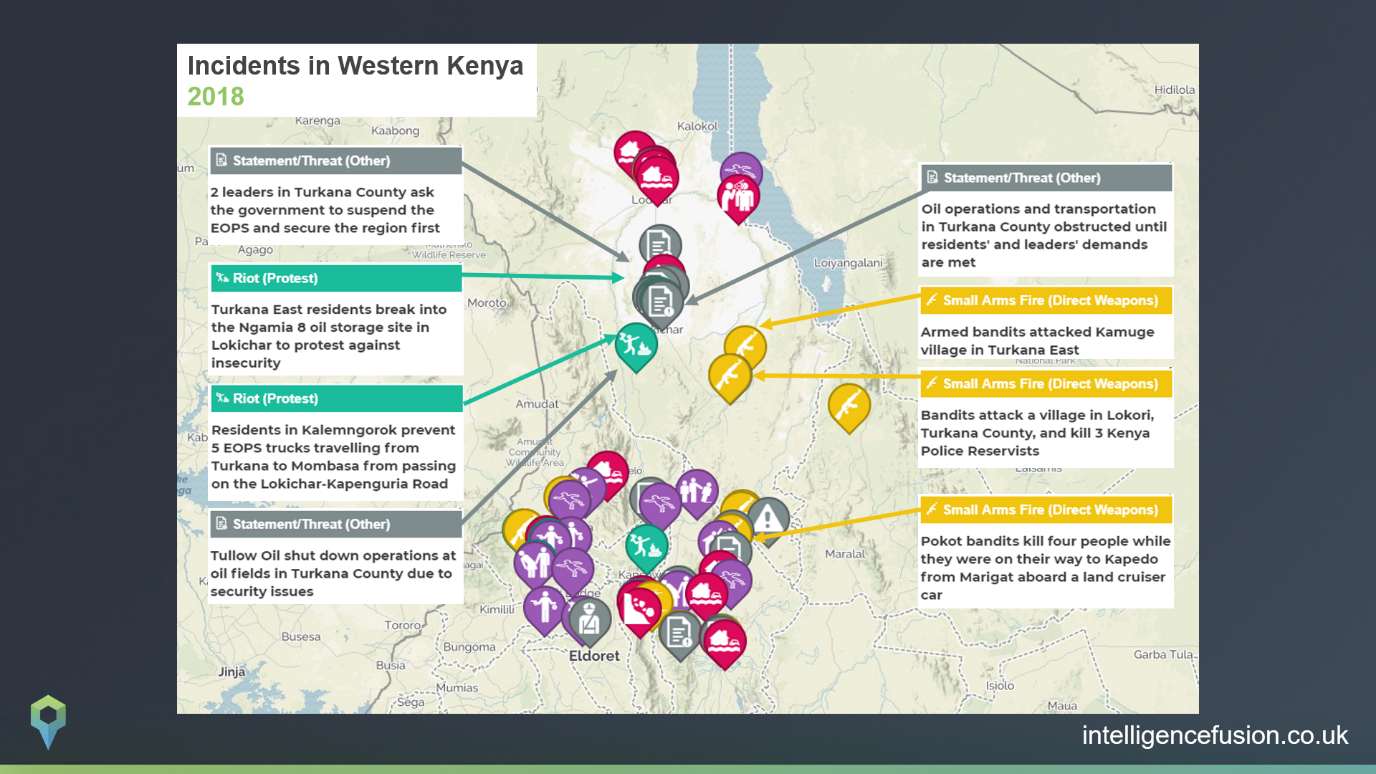

Kenya: Disruption of Oil Production

After much anticipation, the Early Oil Pilot Scheme (EOPS) marked the beginning of the transport of crude oil from Turkana County to Changamwe by road, until a pipeline is built to Lamu port, where it will be stored and exported in early 2019. Concerns surrounding insecurity, employment and infrastructure were evident before and the day the scheme began. Marking its beginning, President Uhuru Kenyatta promised to deploy more police in Turkana East, an area of high insecurity, and warned owners of illegal firearms to handover their weapons. Turkana East MP Mohammed Ali added that construction of a good road would deter attacks by bandits. On 27th July, protester barricaded the Lokichar-Kapenguria Road in protest against insecurity and employment. Oil operations. On 25th July, oil operations were shut down due to security issues.

Landslides, floods and civil disobedience could also affect oil transportation. Further challenges lie ahead.

Mozambique: Cabo Delgado

Mozambique is projected to become one of the world’s leading suppliers of LNG. Gas reserves (approximately 180 trillion cubic feet of gas) are located in the Rovuma Basin in Mozambique’s mineral rich Cabo Delgado region. Hundreds of families have been displaced and over 50 people killed, many of them beheaded, in attacks by Al Sunnah wa Jama’ah. Attacks by have, so far this year, peaked in June (at least nine). The U.S. and a host of other western nations issued a travel advisory warning against travel to the region. The U.S. warned its citizens to leave Palma, warning against possible imminent attacks on commercial and government centres. Local staff Anadarko staff refused to go to work fearing an attack by Al Sunnah militants. According to local researchers, the group is partly commanded from Tanzania, where its spiritual leaders are supposedly based. Its short-term goals are reportedly to consolidate control of illegal resource trafficking routes. Local political, social and economic factors are said to be behind the groups’ emergence.

Most attacks have occurred in remote villages which are difficult to access and are poorly secured. However, PRM and FADM positions have also been attacked. The group’s organisational structure is network based with several cells retaining some autonomy. However, there is said to be a strong link to a central command. Cabo Delgado is among the poorest and least developed provinces of Mozambique and the local population will want to see a quick upturn in their living standards and economic opportunities once the country begins to export LNG. Unemployment and poverty are among the key drivers behind the emergence of Al Sunnah and if these are not addressed, further challenges lie ahead to facilities onshore and offshore.

Conclusion

The upstream, midstream and downstream oil and gas sectors face continued complex challenges. Navigating the complex socio-political terrain requires a comprehensive assessment of varied factors and how each of them shape each other and subsequent local conditions.

Intelligence Fusion record a range of incidents to give a complete picture of local conditions in regions across the world. We collect almost 10,000 incident each month – five times more than most other providers. We also lead the way in coverage, operating in every country and reporting on every incident type.

The easiest way for you to understand the depth and breadth of our data is to see it for yourself. Download our FREE data sample to see;

- The sheer volume of data we collect

- The global coverage we provide

- The depth of information we disseminate

- The spectrum of sources we analyse

- The scale, detail and nature of the threats we identify

You can download one month’s worth of IF intelligence, for free, here. You’ll need access to Google Earth in order to view the file. If you don’t have it already, you can download it really quickly here.