Redefining Semiconductor Production and Supply Chains: Taiwan, China, and Southeast Asia

How viable is Taiwan’s future as a semiconductor powerhouse? How is the market impacted by US-China relations? What does this mean for manufacturing? What opportunities exist for other Southeast Asian countries? How can businesses operating in this industry mitigate risk?

Key takeaways

- Both recent and long-term geopolitical events have affected production and supply chains for Taiwan’s dominance in the semiconductor industry.

- Long-term effects—including the aftermath of the Covid-19 pandemic and growing tensions between the PRC and US/Taiwan—coupled with new events—such as the January 2024 Taiwan elections and the emergence of tech industries in the rest of Southeast Asia—raise new possibilities and threats to the industry and its global stakeholders.

- New possibilities include the redistribution of supply chains in general—from China and Taiwan to neighbouring states such as Vietnam for greater portfolio diversification and minimisation of risk for businesses.

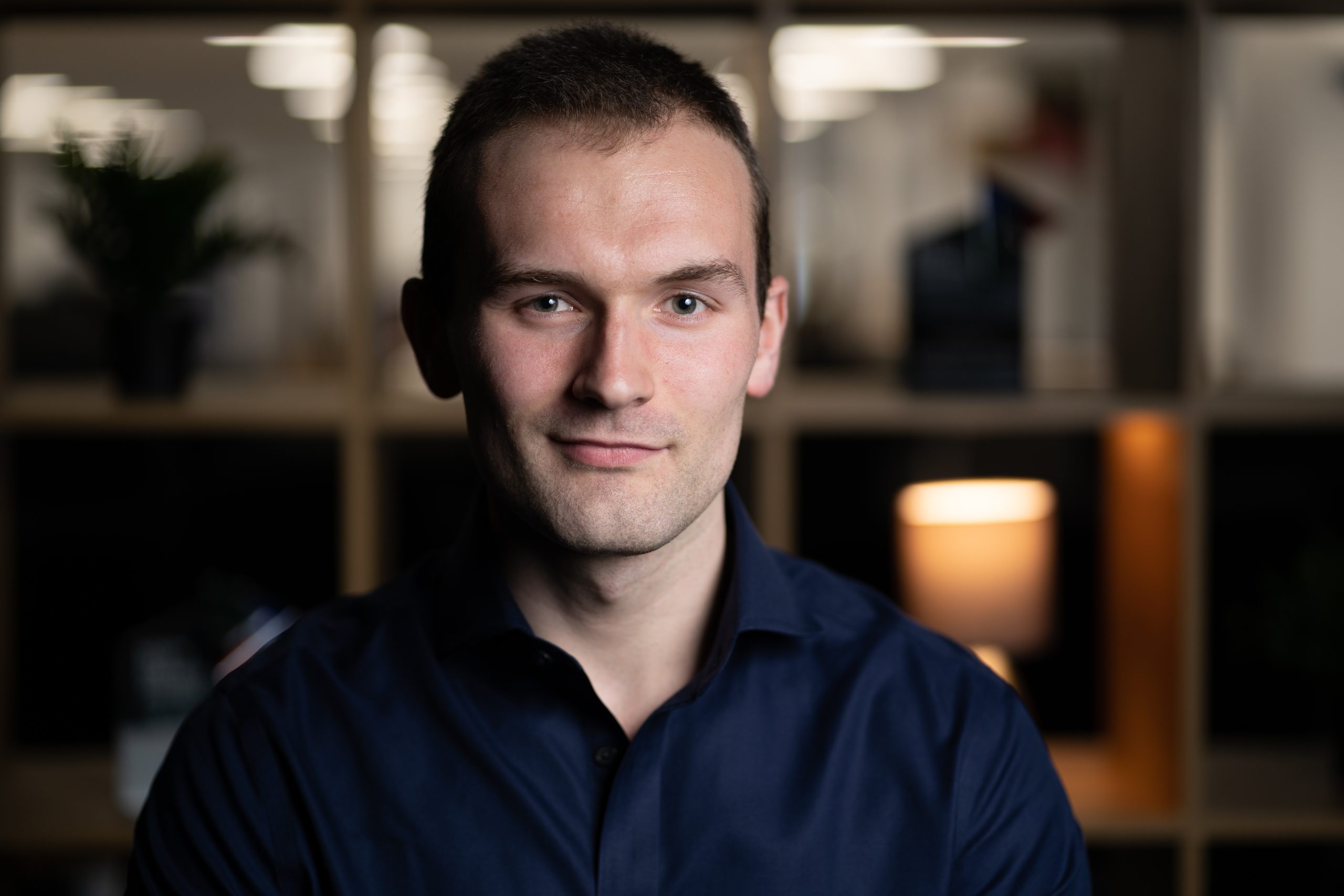

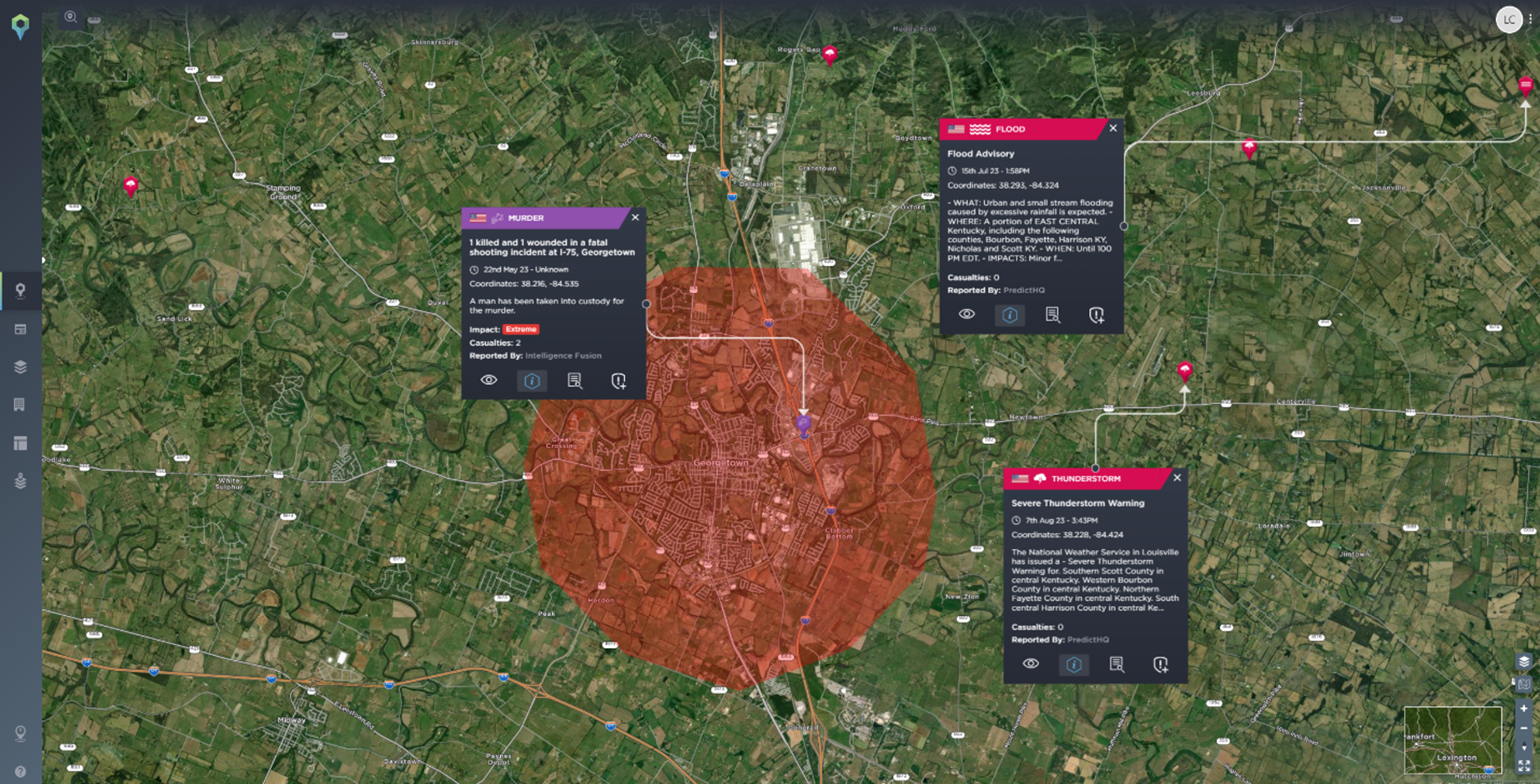

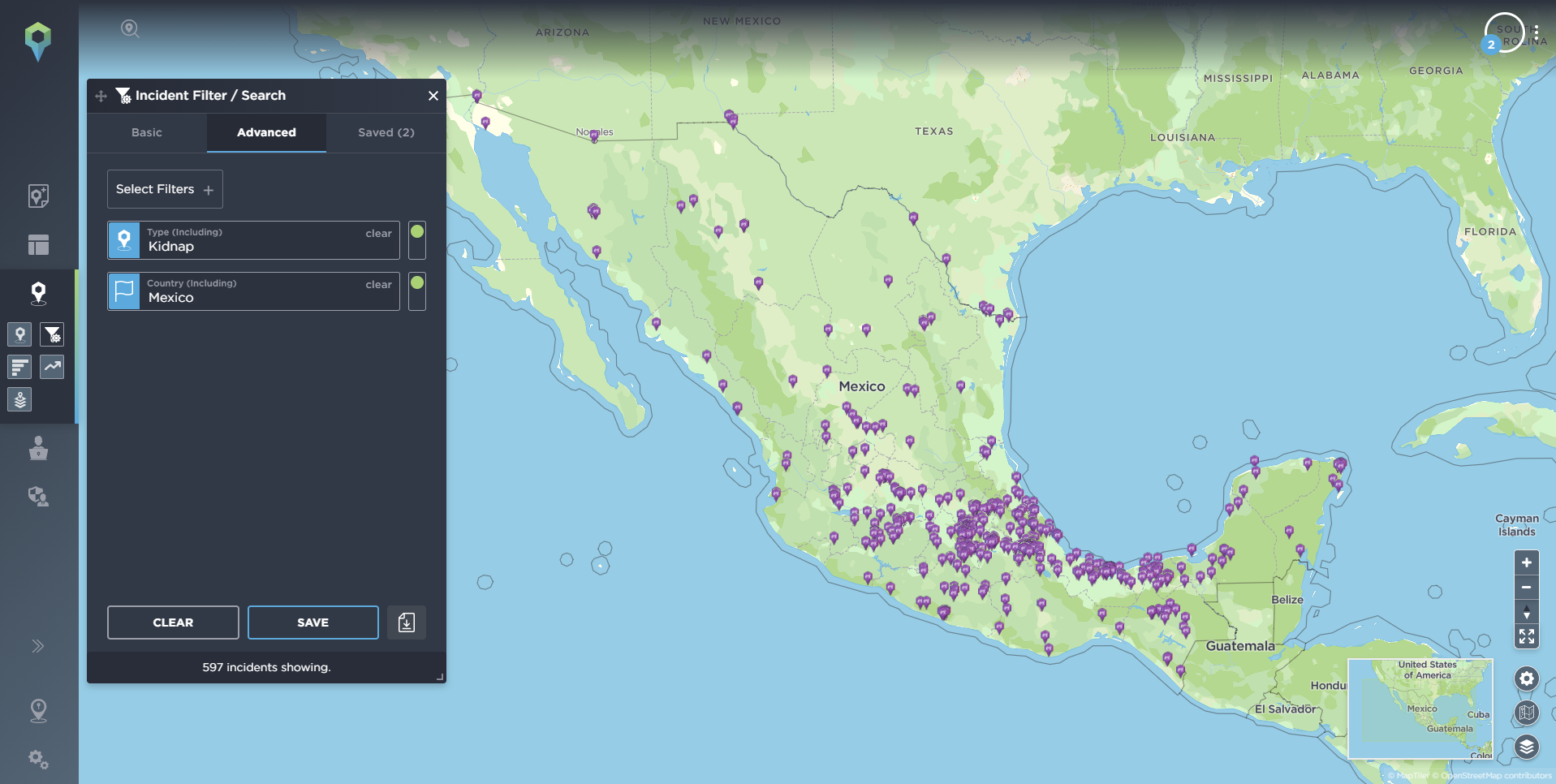

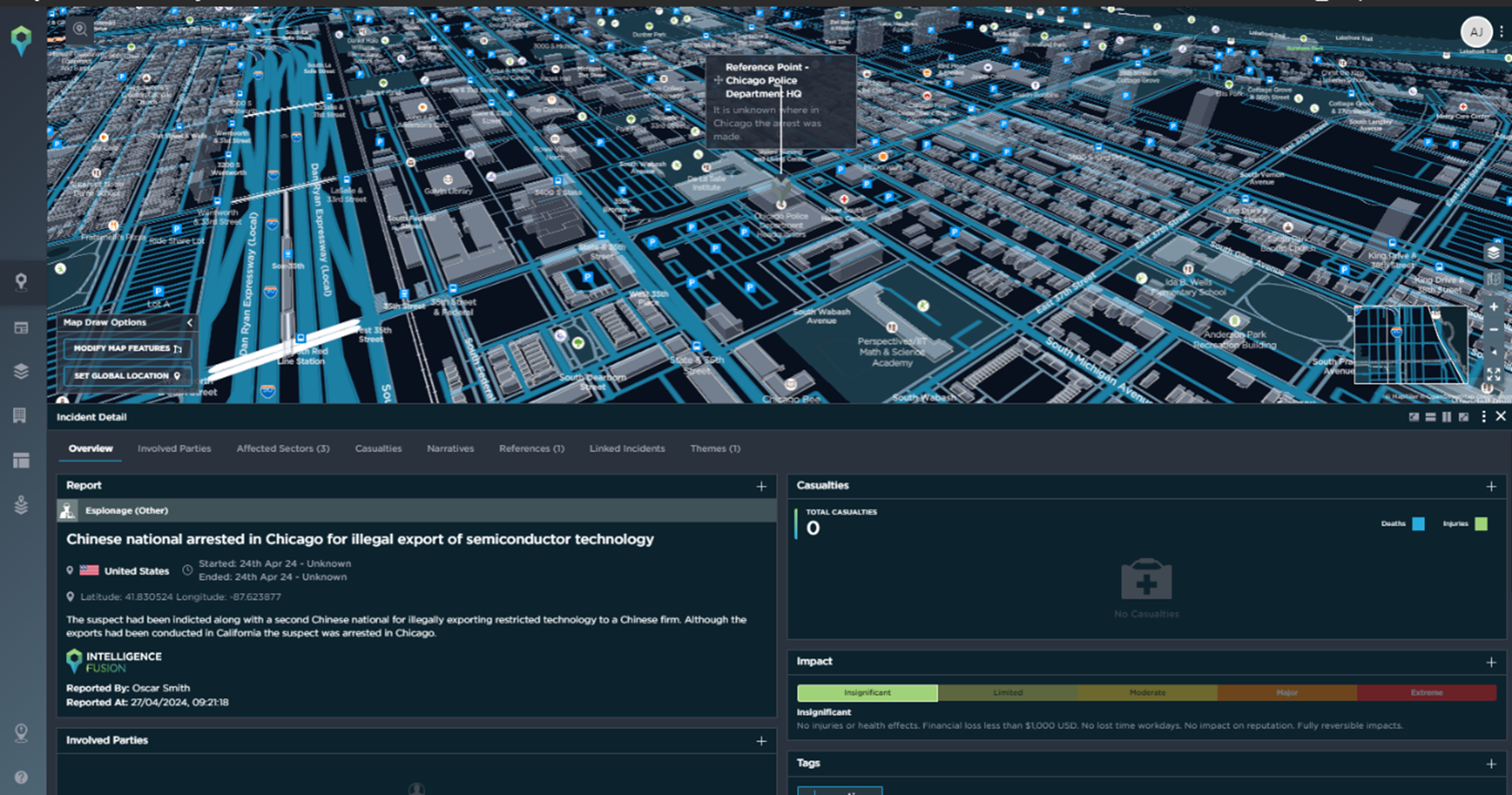

Figure One: Global incidents involving and affecting the semiconductor industry. [Image source: Intelligence Fusion]

Background

Taiwan enjoys possessing a large share of the semiconductor industry within the global tech market, accounting for 90 percent of the global production capacity of microchips. Alongside South Korea’s Samsung, the Taiwan Semiconductor Manufacturing Company (TSMC) is one of two companies in the world that produces the most advanced and leading-edge 2 to 7 nanometre chips. TSMC is also Taiwan’s largest company, thus serving both as the country’s main revenue generator and employer and the world’s key supplier of advanced technologies.

The importance of Taiwan to global supply chains and its tensions with China have long made it a vulnerable target for causing major disruption to the world economy. Besides this, a plethora of recent geopolitical/economic developments and issues have exacerbated its fragile position. Initially, the Covid-19 pandemic led to a boom in the consumption of electronic products. This, in turn, increased the demand for semiconductors to facilitate greater levels of manufacturing to meet supply and demand. However, the aftermath of the pandemic caused the demand for consumer electronic products to decrease due to lockdowns being eased. Many of the companies producing these products are supplied by TSMC. Apple—which is TSMC’s largest customer—reported a decline in its overall sales for two quarters in a row in mid-2023. As a result of its own customers demanding less supply of semiconductors, TSMC had a drop of 10 percent in revenue in the 2022-2023 financial year.

What Has Happened?

An escalation in the historical tensions between Taiwan and the People’s Republic of China (PRC)—coupled with growing concerns for the island’s security—has cast doubt on the viability of Taiwan’s future as a semiconductor powerhouse. During the build-up to Taiwan’s presidential election on 13th January 2024, the Chinese Communist Party (CCP) displayed greater hostility in its rhetoric towards the nation. In his New Year’s Eve address, President Xi Jinping reiterated China’s pledge to unify Taiwan—with 2024 being the 75th anniversary of the PRC. Concerns for potential conflict were exacerbated once the Taiwan election declared the re-election of the Democratic Progressive Party (DPP) for a third term under the new presidency of Lai Ching-te. The DPP’s firm opposition to the CCP’s ‘One China’ notion will likely increase the PRC’s resolve and willingness to reclaim Taiwan via force.

The PRC’s tensions involving the semiconductor industry are not exclusively with Taiwan but also with the United States in the form of trade restrictions. On 7th October 2022, the US Bureau of Industry and Security issued new regulations on the exports of semiconductors and certain semiconductor manufacturing equipment. The regulations were interpreted as an attempt to block Chinese access to high-end artificial intelligence chips amid increasing US-China tensions. Along with the PRC’s growing hostility towards Taiwan, the US’s attempts to mitigate Chinese competition will also aggravate the PRC’s further economic decoupling from the US. This is further evident in the same New Year speech Xi used to reiterate the PRC’s One China notion—Xi arguing for China’s pursuit of technological self-sufficiency to be a priority as a solution to its fragile trade relationship with the US.

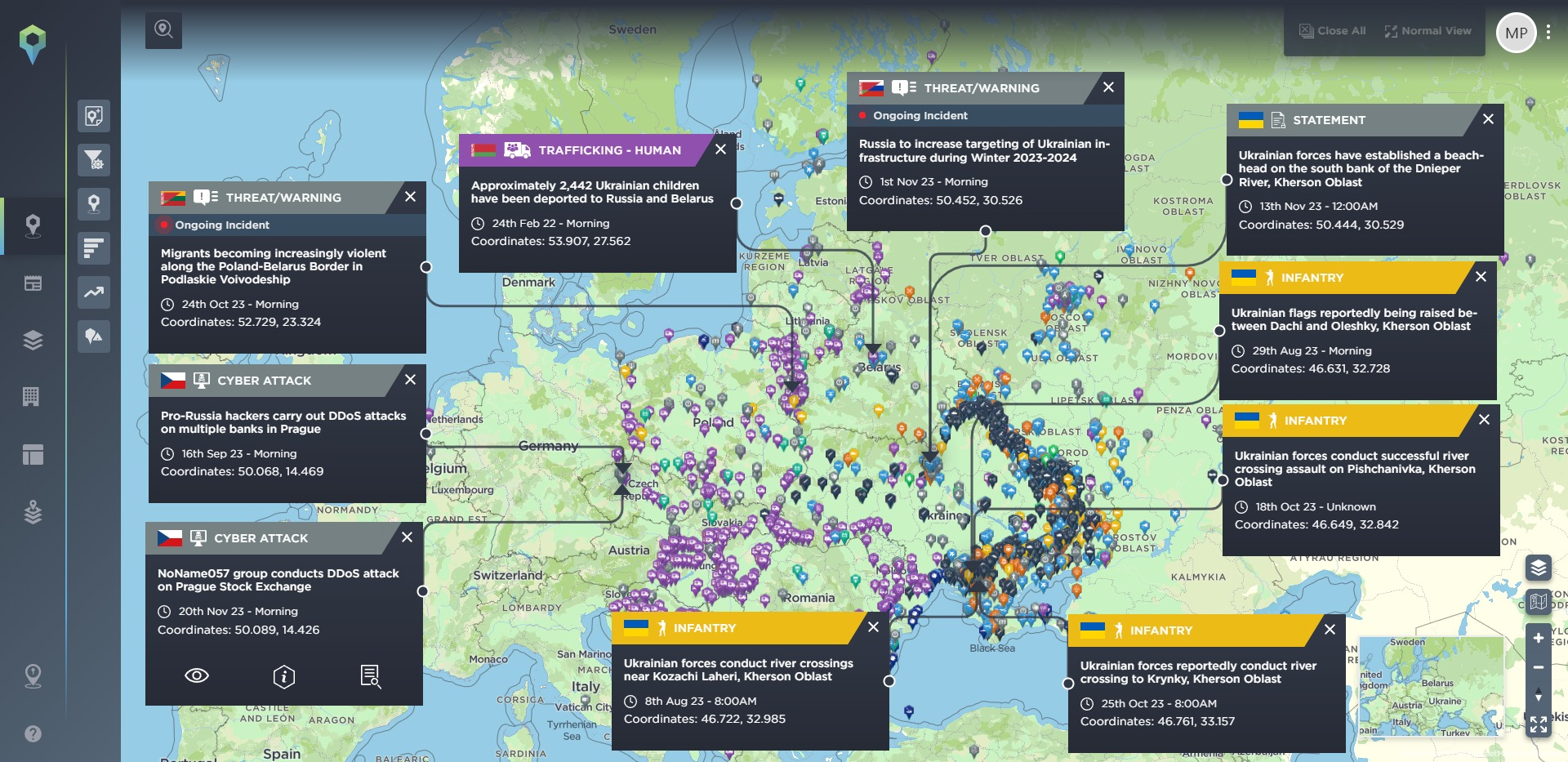

Figure Three: An example of an arrest in the US for offences related to semiconductor exporting. [Image source: Intelligence Fusion]

What Next?

The January 2024 election in Taiwan was unlikely to shift the chip supply chain regardless of the outcome. However, it is a portend of the changing political and economic landscape between Taiwan and the PRC, which has reduced trade and the economic interdependence between the two countries. This year, Taiwan’s investment in China had fallen to its lowest level since 2001, an indicator that it is seeking to economically protect itself amidst growing tensions – both between the US and China as well as its own with the latter.

Like the election, the regulations issued by the US on semiconductor exports are likely to have a minimal impact on chip manufacturers in the short term. However, it will be more significant for equipment makers to use the technology, as they have a wider presence and direct interests in other markets, such as the PRC. This forces them and stakeholders to rethink the structure of their supply chains, causing them to diversify their portfolio to other countries for manufacturing to mitigate risk. Neighbouring states within Southeast Asia, such as Singapore, Malaysia and Vietnam, have offered themselves as alternative hosts for semiconductor supply chains. The ability to facilitate manufacturing varies between countries. While Singapore and Malaysia established themselves in the growing global chip supply chain in the 1960s and 1970s, Vietnam is a latecomer in comparison.

Regardless of their varying degrees of infancy in the tech sector compared to Taiwan and the PRC, the measures and developments witnessed in the southeast nations are promising for stakeholders in the semiconductor industry. This includes Taiwan’s TSMC. In January 2024, the Singapore government had allegedly proposed significant land, water, power, and talent benefits—along with exceptional tax and subsidy incentives—to attract the establishment of a factory from TSMC and its subsidiary, Vanguard International Semiconductor Corporation (VIS). This has been interpreted as one of many attempts to turn the Southeast Asian region into a supply chain hub for the ‘post-China era.’

Vietnam is likely to become one of the most significant actors in the semiconductor industry. This is primarily due to its warming of relations with the United States government and American tech companies such as Nvidia and Apple. In September 2023, the US State Department announced a partnership with Vietnam under the Chips Act, providing USD 500 million for incentives over five years to ensure semiconductor supply chain security. During a visit to the country in December 2023, Nvidia President and CEO Jensen Huang praised Vietnam’s potential and opportunities to branch out its semiconductor and AI industries, referring to it as Nvidia’s ‘second home’. By that month, Nvidia had invested USD 250 million in Vietnam. This is significant, especially with Nvidia becoming the world’s most valuable company in June 2024.

Speak to us today to understand how Intelligence Fusion and Sigma7 can help you reduce risk in the semiconductor industry.

At Intelligence Fusion, we report over 20,000 new incidents each month with a database of over 1,300,000 historical incidents that can be used for context and planning. Last year, 12% of incidents affecting the manufacturing industry were reported in the US, and 10% were reported in China. We reported over 100 extreme or major incidents in Taiwan and multiple incidents related to the Chinese Communist Party, including corruption, protests, bribery, and more. Secure your free demo of the platform here.

As part of Sigma7 risk mitigation, our clients benefit from a comprehensive risk management solution. This includes access to business intelligence analysts, comprehensive training solutions, embedded security support, risk engineering solutions, and forensic accountants. This holistic approach ensures that risk and security teams are well-equipped to handle any situation. Book an introduction call with a member of the team to understand how they can help you.